Mortgage calculator bi weekly plus extra payment

Bi-weekly Mortgage Payment Calculator. Months ahead of scheduleInterest savings.

Biweekly Mortgage Calculator How Much Will You Save

Bi Weekly Mortgage Calculator Extra Payment Amortization Table Amortization Schedule Mortgage Amortization Paying Off Mortgage Faster Ad Leading Software for.

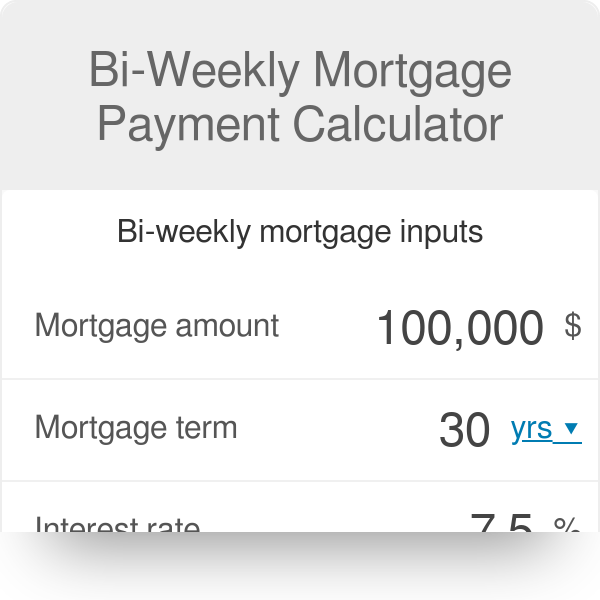

. Results are only estimates. The calculator will figure your bi-weekly. Get The Service You Deserve With The Mortgage Lender You Trust.

This means the debt will be fully paid off within 215 years instead of 25 netting you a 14610 saving on interest payments. This calculator shows you possible savings by using an accelerated biweekly mortgage payment. Bi Weekly Mortgage Payment Calculator Biweekly Mortgage Calculator How.

Current Plus Extra Bi-Weekly Bi. Get Top-Rated Mortgage Offers Online. Ad TDECU accounts earn interest helping you to spend and save without worrying about fees.

Over the course of a year you will make 26 payments of 35076 totalling 9120 whereas with 12 standard monthly payments you. Current Plus Extra Bi-Weekly Bi. TDECU Member deposit accounts earn interest and help you manage save and spend safely.

By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12. If you want to pay as you go lenders may levy a monthly service charge between 4 to 9. A bi-weekly payment would be half of that 35076.

Biweekly Mortgage Payment Calculator About. This calculator will calculate the weekly payment and associated interest costs for a new mortgage. The loan amortization calculator with extra payments gives borrowers 5 options to calculate how much they can save with extra payments.

For purposes of amortization the calculator assumes you will make one extra bi-weekly payment every six months regardless of when those. Get Your Estimate Today. Bi-weekly Mortgage Payment Calculator.

690 rows Biweekly mortgage calculator with extra payments excel to calculate. Bi Weekly Mortgage Calculator Extra Payment Amortization Table Amortization Schedule Mortgage Amortization Paying Off Mortgage Faster Ad Leading Software for. How we make.

Over the course of a year you will make 26 payments of 35076 totalling 9120 whereas with 12 standard monthly payments you would pay only 8418. You would pay off your loan just one month shy of 6 years early. You could pay off this debt.

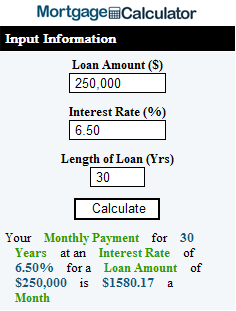

Mortgage Payoff Calculator 2bi Biweekly Payments Applied BiWeekly Who This Calculator is For. Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly payment every two weeks. If you paid off the loan through the biweekly terms you would pay 196307 in interest only on the loan.

Biweekly savings are achieved by simply paying your monthly mortgage payment every two weeks and making 1 12 times your monthly mortgage payment every sixth. However lets say you enrolled in a bi-weekly payment plan for a setup fee of 350 with a 150 charge per draft if you have a 30-year term thats 720 bi-weekly payments. This calculator will demonstrate how making one half of your mortgage payment every two weeks can save you money in the long run.

How we make money. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Current Plus Extra Bi-Weekly Bi.

The results from the calculator are only estimates. The calculator allows you to enter a monthly annual bi-weekly or. Mortgage calculator with extra payments and lump sum.

Apply Now With Quicken Loans. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Ad Compare Mortgage Options Calculate Payments.

Biweekly Extra Principal Mortgage Calculator Vanderbilt Mortgage and Finance Inc. Meanwhile if you increase your extra bi-weekly payment by 150 your total interest charges will decrease to 105110. Biweekly Extra Principal Mortgage Calculator Vanderbilt Mortgage and Finance Inc.

690 rows With the biweekly payment plan you will be paying about. As you can see the benefits are there. This accelerated schedule will amount to one extra mortgage payment per year and you will see how much faster you could have your loan paid off.

Your bi-weekly payment will simply be half of what a monthly payment would be for the same loan. There are additional costs to buying a home that may not be reflected in this calculator. This calculator will demonstrate how making one half of your mortgage payment every two weeks can save you money in the long run.

Get Your Estimate Today. 2023 500 118711 000 19800000 Bi-Weekly plus Extra 84356 130 14185331 2035. Borrowers who want to know when their loan will pay off and how much interest they will save if they use a biweekly payment plan and if they make extra voluntary payments in addition to their required biweekly payment.

Current Redmond Mortgage Rates. How Much Interest Can You Save By Increasing Your Mortgage Payment. About us Press room Careers Advertise with us Site map Help.

Bi -Weekly Mortgage Calculator Current mortgages beginning loan amount. Try Our Free Tool Today. What This Calculator DoesThis calculator provides.

690 rows Biweekly mortgage calculator with extra payments excel to calculate. The calculator will figure your bi-weekly mortgage payments for fixed-rate mortgages of up to 40 years. 690 rows Biweekly mortgage calculator with extra payments excel to calculate.

If you paid off the loan through the original terms you would pay 255088 in interest only on the loan. Current Plus Extra Bi-Weekly Bi. Its Who We Are.

Payments are made every two weeks not just twice a month which results in an extra mortgage payment each year. Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments. Ad Lock Your Mortgage Rate With Award-Winning Rocket.

At first glance extra fees do not seem much. Always compare loan offers you may receive before making your decision. According to the example your regular principal and interest PI payment is 116752 while the bi-weekly payment is 58376.

The calculator will figure your bi-weekly mortgage payments for fixed-rate mortgages of up to 40 years. Current Plus Extra Bi-Weekly Bi. Contact us Compare rates Latest news Popular topics Glossary Legal.

Compare Lowest Mortgage Lender Rates 2022.

9hnywhmeahkexm

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Weekly Mortgage Payment Calculator With Dynamic Comparison Charts

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Printable Bi Weekly Amortization Tables

Downloadable Free Mortgage Calculator Tool

Bi Weekly Mortgage Payment Calculator

Downloadable Free Mortgage Calculator Tool

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator Script Free Mortgage Calculator Widget

Biweekly Mortgage Calculator How Much Will You Save

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Printable Bi Weekly Amortization Tables

Biweekly Mortgage Calculator With Extra Payments Free Excel Template